Solar tax credit

While the solar tax credit has made solar significantly more affordable for homeowners, it will begin to decrease in 2020. We’ll show you how much you can save with the solar tax credit and what these changes could mean for you.

What is the solar tax credit?

Last updated on January 01, 2020 by Scott Nelson

The federal solar tax credit, formally known as the solar Investment Tax Credit (ITC), is a credit equal to 26% of the qualified system costs of installing a photovoltaic (PV) solar system. The ITC was established as a part of the Energy Policy Act of 2005 in an effort to boost the US renewable energy market.

How does it work?

The total value of the solar tax credit can easily be calculated by taking 26 percent of the solar system installation cost. There is no limit to the value of the credit. Example:

If your residential solar energy system costs $20,000 and is installed in 2020, your tax credit would be $20,000 x 26% = $5,200.

It’s important to note that the federal solar tax credit is a nonrefundable tax credit. This means that you only get a refund up to the amount you owe in federal taxes. Example:

If you owed $5,000 in federal taxes and had a $6,000 solar tax credit, you would take $5,000 of the credit in the first year, and then carry over the remaining $1,000 of the credit to the following taxable year.

The solar tax credit is only available for the owner of the system. Therefore, homeowners with a PV system through a Solar Lease or PPA (Power Purchase Agreement) are not personally eligible for the solar ITC.

Solar tax credit step-down

Free solar tax credit calculator

We’ve created a simple, free calculator for figuring out what your solar tax credit would be worth and how long it could take to claim it. This calculator is intended for anyone from solar installers to homeowners.

Solar tax credit calculator

How do I claim the credit?

Residential

You can claim the solar tax credit for a residential solar panel system using IRS Form 5695 (Residential Energy Tax Credit) when you file your taxes.

Detailed information about Form 5695 can be found on the IRS site here.

The home served by your solar PV system does not have to be your main home.

Commercial

You can claim the tax credit for a commercial solar panel system using IRS Form 3468 (Investment Tax Credit).

Detailed information about Form 3468 can be found on the IRS site here.

Note: This material has been prepared for informational purposes only. For formal advice regarding the tax credit, please consult with a tax professional.

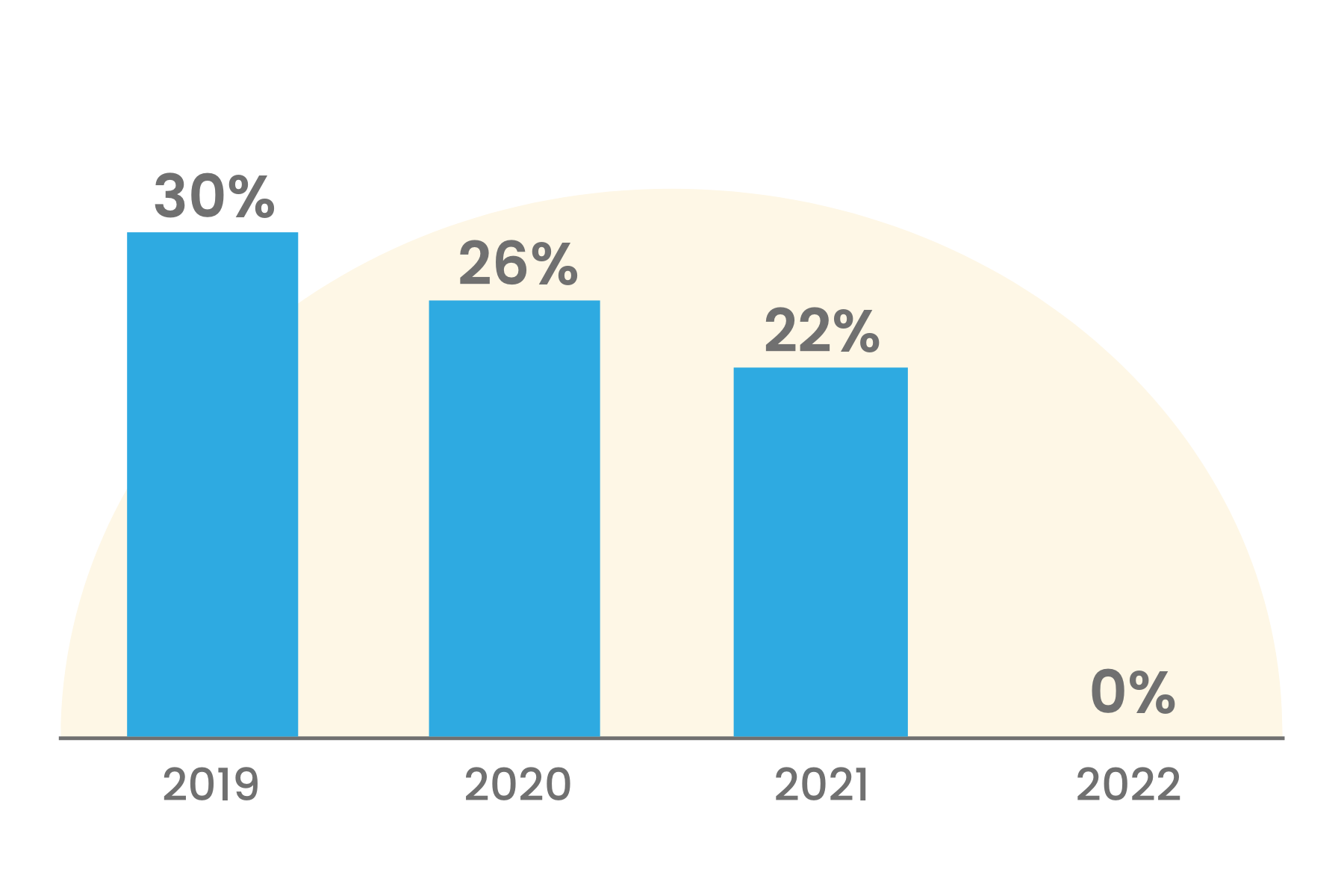

Upcoming changes to the solar tax credit: Residential

Per IRC §25D(g), the IRS lays out the following schedule for the residential solar tax credit:

Residential solar tax credit step-down

| Date placed in service | Tax credit |

|---|---|

| Before 1/1/2020 | 30% |

| 1/1/2020 - 12/31/2020 | 26% |

| 1/1/2021 - 12/31/2021 | 22% |

| On or after 1/1/2022 | 0% |

To receive the residential solar tax for a given year, the system must be "placed in service" during that year. According to SEIA: "There is no bright-line test from the IRS on what constitutes 'placed in service,' but the IRS has equated this with completed installation in a Private Letter Ruling."

How do these changes affect newly built homes with solar?

If a PV solar system is purchased along with the construction of a new home, the homeowner’s tax credit amount will be determined by the year they move into the house. For example: If a homeowner’s new house and solar system have both completed installation in December 2019 but they move into the home in January 2020, the homeowner’s tax credit will be worth 26% of the solar system cost.

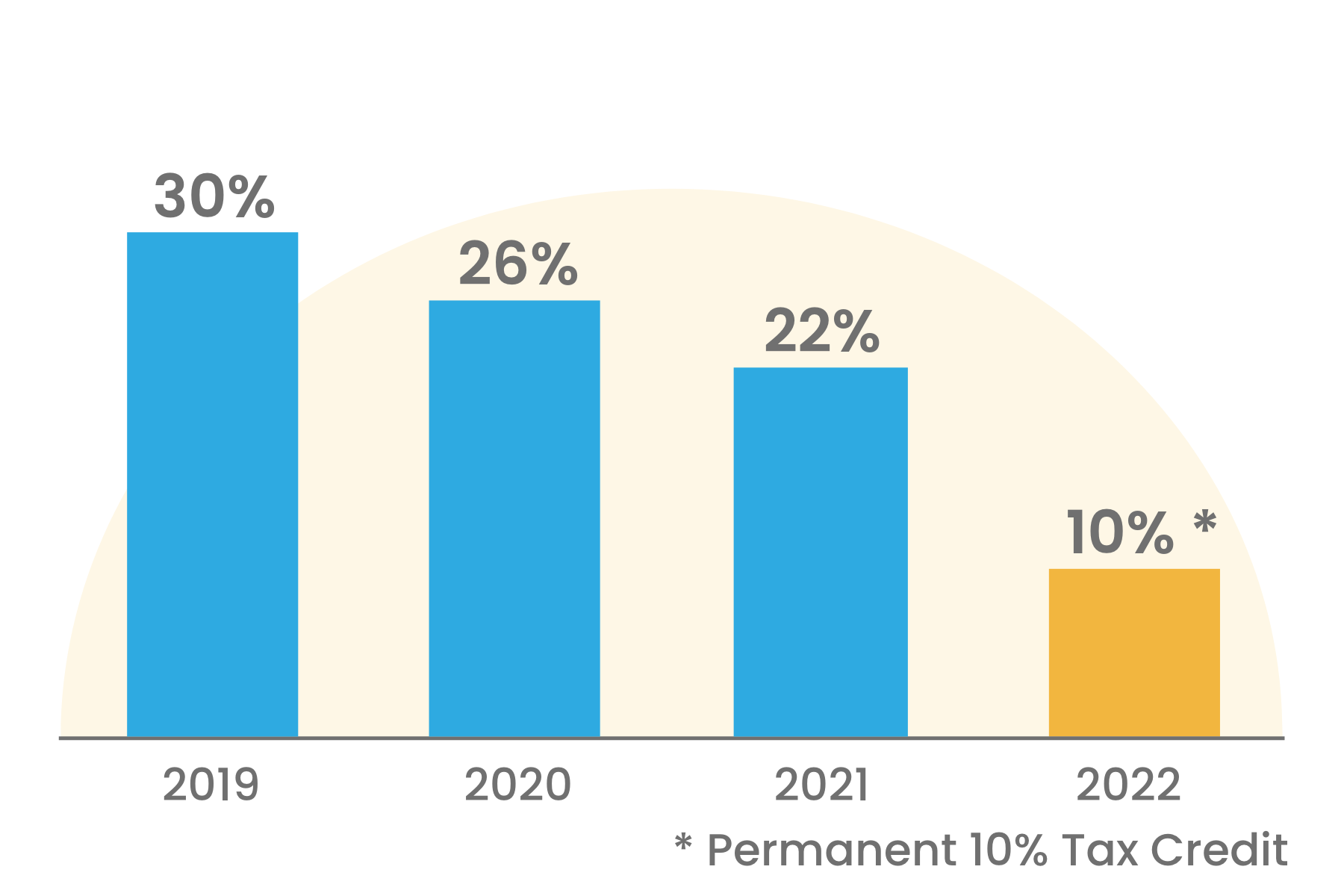

Upcoming changes to the solar tax credit: Commercial

Per Notice 2018-59, the IRS gave guidance on the Consolidated Appropriations Act, 2016 which lays out the following schedule for the ITC:

Commercial solar tax credit step-down

| Date construction begins | Tax credit |

|---|---|

| Before 1/1/2020* | 30% |

| 1/1/2020 - 12/31/2020* | 26% |

| 1/1/2021 - 12/31/2021* | 22% |

| On or after 1/1/2022 | 10% |

*Must be placed in service before 1/1/2024

Unlike residential systems, commercial systems can benefit from safe harbor provisions. This means that the amount of the tax credit is determined by the year construction of the solar system was started. Tax credits worth 22% - 30% of the system cost must be placed in service before 1/1/2024.